A number of taxpayers own personal property which they rent to their own business. The rental property typically includes equipment, vehicles, and furniture.

As an example, a photographer may own various types of cameras and other photographic equipment that he used in his self-employment business as a photographer. He decides to incorporate and allow the new company to use his equipment. However, he wants to keep ownership of his personal equipment. So, he rents the equipment to his corporation for a fair rental amount.

This is an important point. If you rent property to your business, draft and sign a formal lease agreement and pay a commercially reasonable rental amount. Transactions between related parties typically come under close scrutiny by the IRS. If the IRS finds the rent paid by the corporation unreasonable, the IRS can recharacterize the rent as a distribution of profits. That will result in a disallowance of part of the rental expense as a deduction for the corporation, which will increase the corporate profit. The excess payment to the shareholder will be classified as a dividend distribution.

The tax treatment for renting personal property differs from real estate rentals, and how you classify the rental activity will affect how you report income, expenses, and potential self-employment tax.

Classification of Personal Property Rentals

The tax code treats personal property rentals in three ways:

1. Business. If your primary purpose is to earn income and the activity is continuous, it is considered a business. You must report the income on Schedule C, subject to self-employment tax. There are factors that are taken into account to determine if a rental activity rises to the category of a business vs a for-profit activity.

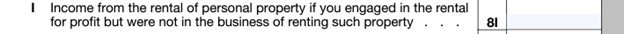

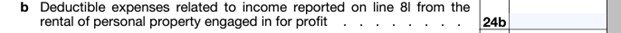

2. For-profit activity. If the rental is profit-motivated but sporadic, it’s a for-profit activity. For-profit activities are engaged in to earn money but do not rise to the level of a business. Report income from a rental for-profit activity as “other income” on Form 1040, Schedule 1, line 8l. Report expenses from the activity on Schedule 1, line 24b as an “above the line” adjustment to income. Since the activity is not a business, there is no self-employment tax.

For example, a taxpayer may own a vintage car that he rents to film production companies two or three times a year. The activity is engaged in for profit but is too sporadic to constitute a business. He reports his income and expenses on Form 1040, Schedule 1. He pays no self-employment tax on this rental income. Here are what those line numbers look like:

3. Not-for-profit activity. If the rental activity is primarily for personal reasons (e.g., for recreation), it is considered not-for-profit. You report the income on Schedule 1, line 8j, but you cannot deduct expenses related to the activity. That is because of the Tax Cuts and Jobs Act passed in 2017, effective for tax years 2018 through 2025. However, starting in 2026, unless the law is changed, such expenses will be deductible up to the amount of hobby income as a personal itemized deduction on IRS Schedule A to the extent they exceed 2 percent of the taxpayer’s adjusted gross income. You must itemize your deductions (not take the standard deduction) to have a tax benefit from the expenses.

Here is an image of the correct line number for reporting the gross income from hobby income:

Renting to Your Own Business

If you rent personal property to your own business, the tax implications depend on the business structure:

- Sole proprietorship or single-member LLC. Rentals between you and your business are not taxable events. That is because a single-member LLC is considered a “disregarded entity.”

- Corporation, partnership, or multi-member LLC. Renting to your business is a taxable event. The business can deduct rental payments, and you report the income on your personal tax return.

Self-Rental Rule

The “self-rental” rule applies to renting personal property to a business in which you materially participate. The rule works like this:

- If the rental activity produces net income, it is characterized as non-passive income, meaning you cannot deduct passive losses against this income.

- If the rental activity creates a loss, the loss continues as a passive loss, which you can offset only with passive income. The excess loss is carried over to subsequent years until it is absorbed by passive income.

According to IRS, there are two kinds of passive activities.

- Rental activities, one may even materially participate in them unless he is a real estate professional.

- Trade or business activities in which one does not materially participate during the year.

Portfolio income (interest, dividends, royalties, gains on stocks and bonds) is considered passive income by some analysts. However, the IRS does not generally consider portfolio income as passive.

Self-rental gives you the worst of both worlds—passive classifications.

Grouping

You can avoid the self-rental rules with the grouping election. You may group your property rental with your business when the group forms an appropriate economic unit and

- the rental activity is insubstantial relative to the business activity, or vice versa, or

- each owner of the business activity has the same proportionate ownership interest in the rental activity.

The tax code prohibits grouping real and personal property rentals. However, there is an exception. If you rent the business building or office unit to your business and such rental includes furnished offices, the prohibition on combining activities does not apply. You can group with the business activity under the grouping rules above. Just be aware that the self-rental grouping election does not work with a C corporation.